What is DOTS FastTax?

DOTS FastTax web service provides sales and use tax rate information for all US areas based on several different inputs. The operations that are offered within FastTax take input parameters such as address, city, state, postal code. The service also provides an operation that will take your Canadian province and will return the proper Canadian tax rate information.

How can it be used?

At its core, FastTax is an address to tax rate lookup system. You provide the service with a location and it will return the tax rate or rates for the given area. From there you can use this data in conjunction with your own business logic to easily determine the proper tax rate you should be charging. A common use case is for online retail companies that need to determine the rate to charge for an order. Rates vary greatly depending on where the client is located and if the company has a sales tax nexus in that state. Nexus, also known as sufficient physical presence, is a legal term that refers to the requirement for companies doing business in a state to collect and pay tax on sales in that state. Calculating the proper rate is as easy as determining where your company has nexuses and then performing a tax rate look up via the FastTax web service. These two steps can be done programmatically, thus streamlining your business workflow.

What makes FastTax so powerful?

It may seem like a simple task to take an address and perform a lookup on a tax rate database. In theory it is just identifying a location and then finding the relevant tax rates for it. However, in reality there are many more factors that need to be accounted for to ensure the tax rate being returned is accurate, up to date, and truly relevant for the input address. It is in these aspects where Service Objects’ FastTax goes above and beyond. On top of our tax rate databases that are actively maintained to provide the latest and most accurate tax rate data, our operations benefit from the other services we specialize in. Namely, our address validation and address geocoding services.

How does FastTax go above and beyond?

Through the use of our address validation engine we are able to take an input address and determine its correctness as well as standardize it into its most useable form. Having an address corrected and standardized allows us to more accurately match the location with its corresponding tax rate. On top of address validation, our use of geocoordinates and spatial data allow us to identify boundaries between areas. This could be the difference between charging the proper rate for an area or misidentifying it and missing rates such as county, country district, city district, or even special district rates. Another extremely important distinction that geocoordinates allow us to make is for areas that are unincorporated. FastTax provides an “IsUnincorporated” flag when an address is in an unincorporated area. This allows for your business logic to correctly tax this address by removing any city or city district rates.

FastTax in action

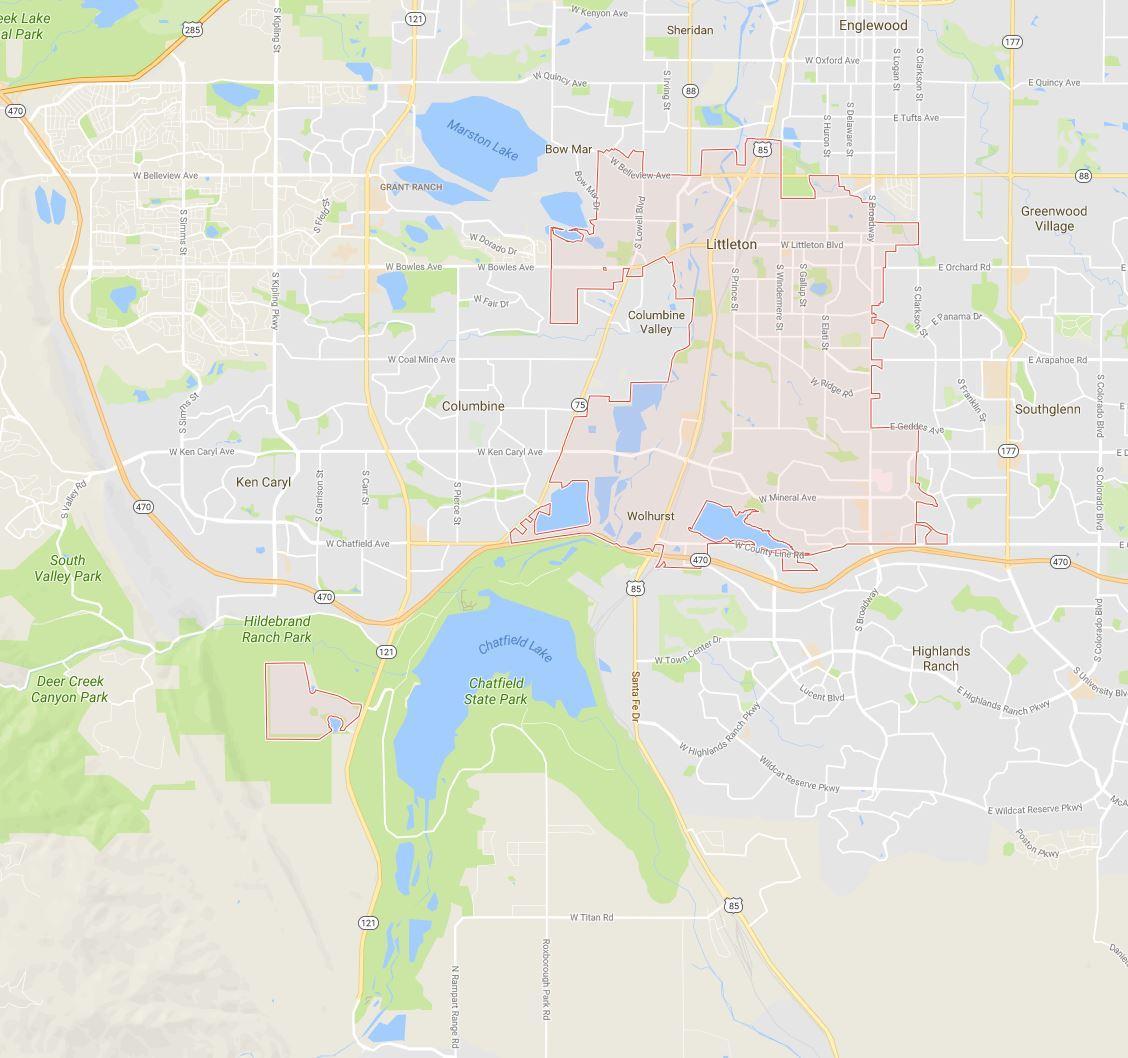

To see the power of FastTax in action it helps to take a look at Google Maps. Let’s take the city of Littleton, Colorado. In fig.1 the city perimeter is outlined in red and its contents shaded in. The Google Maps result shows the officially recognized city limits. Comparing that to the pin shown in fig.2 it is clear that the address in this example falls beyond the city limits. Technically it is identified as part of the city of Littleton but is part of an unincorporated area. Tax rates for this address need to properly account for this geospatial and city boundary information. FastTax excels in identifying these areas and can provide the “IsUnidentified” flag to indicate this address falls into its own special case. With the indicator flag in hand you can properly account for the difference in tax rates.

See how FastTax can help your business. Sign up for your free trial key or send us a list and test up to 500 transactions.