FastTax is our go-to service for your sales and use tax needs. When you enter a US address into this service, it will return the sales (or use) tax rate for this address, as well as some additional information on how this address is taxed. While we do cover the US for sales and use tax, the tax laws are unique for every single state, and not every state has a direct sales tax.

So, do we ignore these states? Not at all! Even if an address is in a state without a sales tax rate, FastTax will return useful information for the address. In addition, there are several states with a tax that acts very similar to sales tax, and we include them in the search. In this article we will go over the states without a sales tax, what they have instead, and how this may appear within FastTax.

NOMAD States

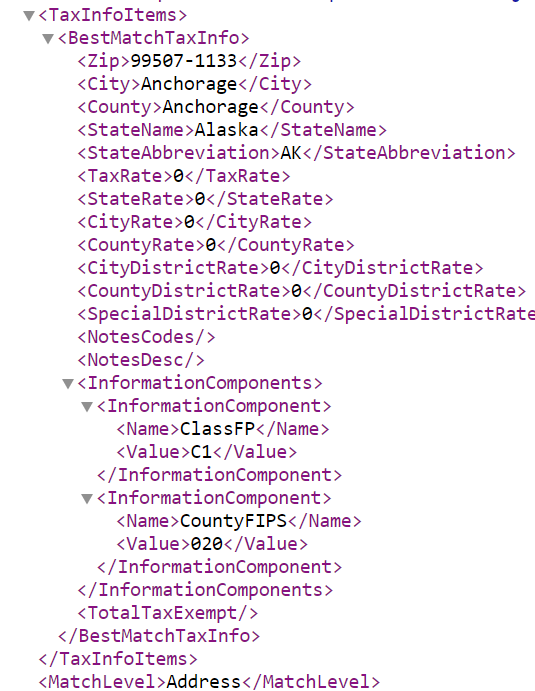

As of 2024, there are five states that carry no sales tax rates, and there is no substitution for their sales tax. They are Alaska, Delaware, Montana, New Hampshire, and Oregon; these states are collectively called NOMAD states. When you look up an address from one of these states, you will still get an output, but the rates will be all zeroes. We can see this with an address from Anchorage, Alaska:

While all the expected tax rates are empty, you can still learn a few things about this address, such as its ClassFP (class of geographic location) and CountyFIPS (each county’s unique Federal Information Processing Standard code). NOMAD states will return nothing for the tax rates, however there are other non-sales tax states that do return rates.

Hawaii and GET

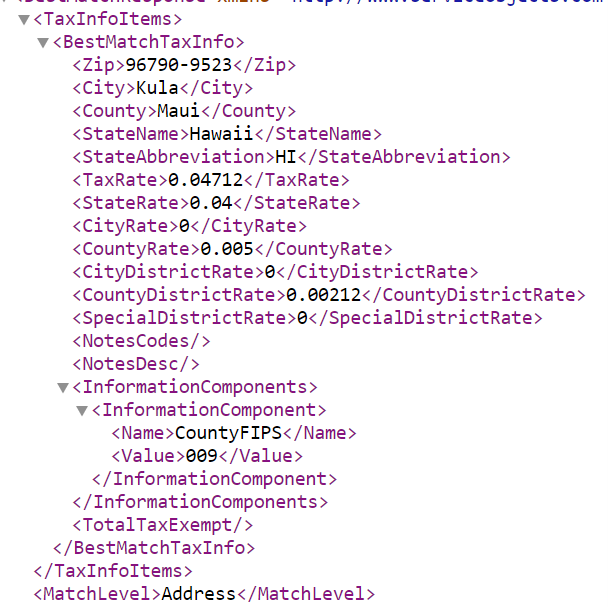

Hawaii does not collect sales tax from consumers like most other states, but instead it has a General Excise Tax, also known as GET. GET is levied on businesses with a nexus in Hawaii, and these businesses in turn collect sales taxes from their customers.

Businesses usually have a GET rate of 4% or 4.5%, and the maximum rates they can charge customers for this rate is 4.166% and 4.712%, respectively. While the GET rate varies from each seller, when you look up a Hawaiian address in FastTax, it will return the maximum rate for the GET for that business:

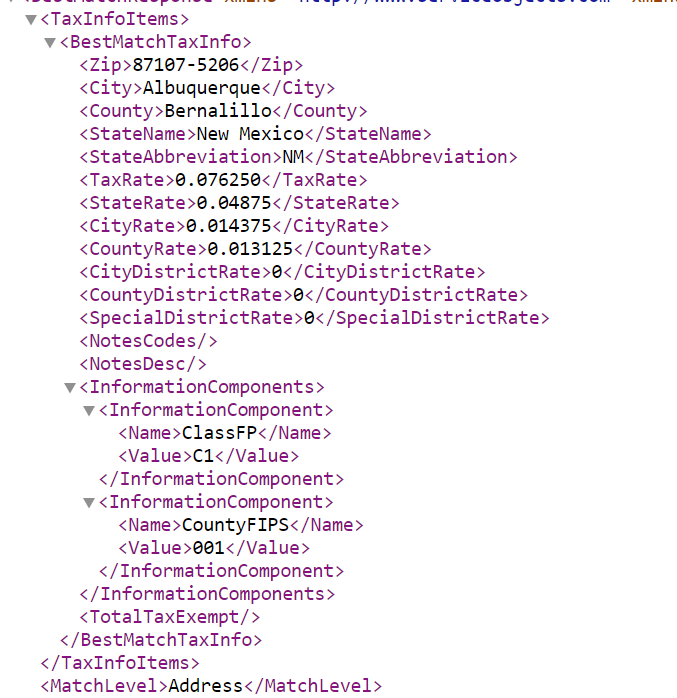

New Mexico and Gross Receipts Tax

Much like the GET is New Mexico’s Gross Receipts Tax, which is a tax on the total gross revenues of a company that doesn’t directly apply to buyers but is necessarily collected from companies. The difference is in how they are represented in FastTax. Every address in New Mexico has a gross receipts tax rate between 5.125% and 8.8675%, which is a culmination of the state gross receipt rate, the county rate, and the local rate. This is like how normal sales and use taxes are broken down, so they are returned in the same fashion:

Keeping Track of Unique Rates

Our goal with FastTax is to provide accurate, up to date sales and use tax rates for US addresses. While not every state follows the normal sales and use tax conventions, we still include them so that our users are properly informed of the business tax functions of every state.